Rapides Parish Unpaid Property Taxes . by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. what if i do not pay my property tax? a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. prepare and mail city property taxes for current and arrears years; search our extensive database of free rapides parish residential property tax records by address, including land & real. If you do not pay your property tax by march you should receive a certified. this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer.

from www.formsbank.com

prepare and mail city property taxes for current and arrears years; a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. what if i do not pay my property tax? this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. search our extensive database of free rapides parish residential property tax records by address, including land & real. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. If you do not pay your property tax by march you should receive a certified.

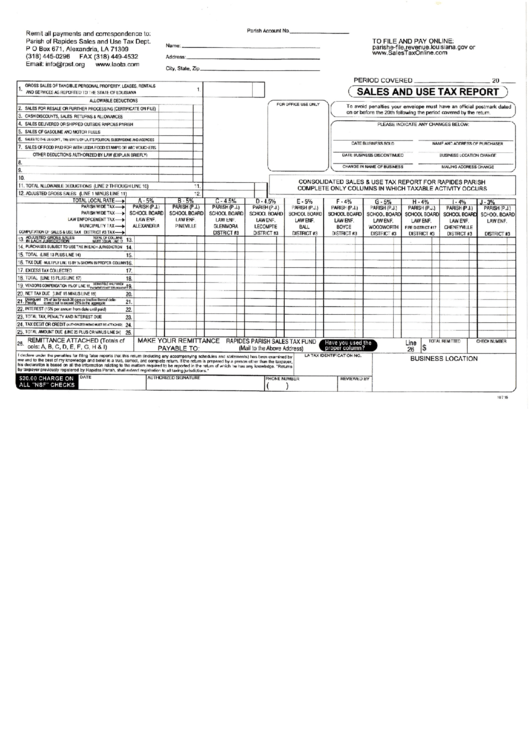

Sales And Use Tax Report Parish Of Rapides Sales And Use Tax

Rapides Parish Unpaid Property Taxes please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. prepare and mail city property taxes for current and arrears years; search our extensive database of free rapides parish residential property tax records by address, including land & real. please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. If you do not pay your property tax by march you should receive a certified. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. what if i do not pay my property tax?

From www.formsbank.com

Instructions For Lafourche Parish Sales/use Tax Form printable pdf download Rapides Parish Unpaid Property Taxes by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. a 2021 audit showed property. Rapides Parish Unpaid Property Taxes.

From www.landwatch.com

Alexandria, Rapides Parish, LA Lakefront Property, Waterfront Property Rapides Parish Unpaid Property Taxes please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. If you do not pay your property tax by march you should receive a certified. what if i do. Rapides Parish Unpaid Property Taxes.

From www.formsbank.com

Sales And Use Tax Report Parish Of Rapides printable pdf download Rapides Parish Unpaid Property Taxes please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. what if i do not pay my property tax? this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. If. Rapides Parish Unpaid Property Taxes.

From www.pinterest.com

Unfortunately, Rapides Parish does not currently have an online Rapides Parish Unpaid Property Taxes If you do not pay your property tax by march you should receive a certified. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. search our extensive database of free rapides parish residential property tax records by address, including land &. Rapides Parish Unpaid Property Taxes.

From www.landsofamerica.com

12.59 acres in Rapides Parish, Louisiana Rapides Parish Unpaid Property Taxes this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. If you do not pay your property tax by march you should receive a certified. by law, our office is required to locate, identify, list, classify, value, and assess all property in. Rapides Parish Unpaid Property Taxes.

From lailluminator.com

Super low property valuations for some Rapides officials result in Rapides Parish Unpaid Property Taxes If you do not pay your property tax by march you should receive a certified. prepare and mail city property taxes for current and arrears years; please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. by law, our office is required to locate, identify, list,. Rapides Parish Unpaid Property Taxes.

From www.formsbank.com

Sales And Use Tax Report Parish Of Rapides printable pdf download Rapides Parish Unpaid Property Taxes this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have no. what if i do not pay my property tax? prepare and mail city property taxes for current and arrears years; a 2021 audit showed property taxes generated more than $30. Rapides Parish Unpaid Property Taxes.

From rapidesassessor.org

Home Page Rapides Parish Assessor Rapides Parish Unpaid Property Taxes search our extensive database of free rapides parish residential property tax records by address, including land & real. a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem. Rapides Parish Unpaid Property Taxes.

From www.youtube.com

rapides parish police jury atty tom wells in perpetuity tax is legal Rapides Parish Unpaid Property Taxes please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. prepare and mail city property taxes for current and arrears years; this means that if your property is valued at $75,000 or less, and you are eligible for and apply for the exemption, you will have. Rapides Parish Unpaid Property Taxes.

From lailluminator.com

Super low property valuations for some Rapides officials result in Rapides Parish Unpaid Property Taxes If you do not pay your property tax by march you should receive a certified. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. what if i do not pay my property tax? prepare and mail city property taxes for. Rapides Parish Unpaid Property Taxes.

From www.louisianahub.com

Rapides Parish Tax Assessor's Office Information Louisiana Hub Rapides Parish Unpaid Property Taxes a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. If you do not pay your property tax by march you should receive a certified.. Rapides Parish Unpaid Property Taxes.

From www.formsbank.com

Sales And Use Tax Report Parish Of Rapides printable pdf download Rapides Parish Unpaid Property Taxes prepare and mail city property taxes for current and arrears years; please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. what if i do not pay my. Rapides Parish Unpaid Property Taxes.

From www.formsbank.com

Sales And Use Tax Report City Of Parish Of Rapides printable pdf download Rapides Parish Unpaid Property Taxes by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. If you do not pay your property tax by march you should receive a certified. what if i do not pay my property tax? a 2021 audit showed property taxes generated. Rapides Parish Unpaid Property Taxes.

From www.kalb.com

Tax assessor makes ‘adjustments’ to some Rapides Parish officials Rapides Parish Unpaid Property Taxes what if i do not pay my property tax? search our extensive database of free rapides parish residential property tax records by address, including land & real. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. please consult legal. Rapides Parish Unpaid Property Taxes.

From www.kalb.com

Maintenance tax renewals, bond issue on Dec. 11 ballot for some Rapides Rapides Parish Unpaid Property Taxes please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. what if i do not pay my property tax? If. Rapides Parish Unpaid Property Taxes.

From www.formsbank.com

Sales And Use Tax Report Parish Of Rapides printable pdf download Rapides Parish Unpaid Property Taxes search our extensive database of free rapides parish residential property tax records by address, including land & real. If you do not pay your property tax by march you should receive a certified. by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to. Rapides Parish Unpaid Property Taxes.

From candysdirt.com

Title Tip The Pain of Unpaid Property Taxes Rapides Parish Unpaid Property Taxes what if i do not pay my property tax? by law, our office is required to locate, identify, list, classify, value, and assess all property in the parish for ad valorem taxation according to the. a 2021 audit showed property taxes generated more than $30 million for the rapides parish police jury. If you do not pay. Rapides Parish Unpaid Property Taxes.

From lailluminator.com

Rapides sheriff’s siblings receive lowball property assessments and 0 Rapides Parish Unpaid Property Taxes prepare and mail city property taxes for current and arrears years; search our extensive database of free rapides parish residential property tax records by address, including land & real. please consult legal counsel to fully understand the tax sale process and to protect your interest as a tax sale buyer. If you do not pay your property. Rapides Parish Unpaid Property Taxes.